Stripe fee calculator: See how much businesses can save with Airwallex

Find out how Stripe’s merchant fees compare to Airwallex’s. Our Stripe fee calculator shows what charges businesses can incur when collecting payments with Stripe, and how much they can save with Airwallex Payments.*

Save more with competitive pricing and fewer currency conversion fees when settling funds like-for-like, in the same currencies as customers’. Receive, manage, convert, and transfer global funds all on one platform.

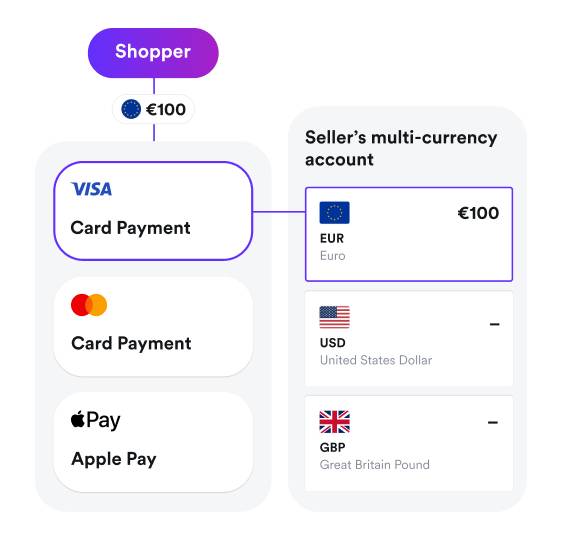

Cut FX fees: Save more with like-for-like settlement

Save on payment processing fees and avoid costly currency conversions with like-for-like settlement. For example, a business in Hong Kong can transact in GBP and settle those funds directly into a local GBP account, without having to convert the funds to HKD and pay foreign exchange (FX) fees. This GBP balance can then be used to pay UK suppliers, further cutting FX fees.

With Airwallex, businesses can settle payments like-for-like in 14+ major currencies using its built-in multi-currency account, without any forced FX conversions. Unlike with Stripe, there's no need to open a separate foreign currency bank account to enjoy these benefits.

What currencies can I settle like-for-like on Airwallex and Stripe in Hong Kong?

Businesses registered in Hong Kong can settle payments like-for-like in 14+ currencies in Airwallex’s multi-currency account. In comparison, Stripe allows like-for-like settlement in USD only, and requires a separate USD currency bank account.

This table shows the like-for-like settlement currencies available in Hong Kong for major card schemes. See our settlement schedule and currencies to view available currencies in other regions and payment methods overview for additional settlement currencies available depending on card schemes and local payment methods.

STRIPE FEES

How are Stripe fees calculated?

Stripe’s processing fees are calculated based on several factors. These include the merchant entity, transaction volume, payment method, and payment currency. Payments may also incur multi-currency management fees, such as settlement fees and conversion fees. Other fees include fixed gateway fees and Stripe’s Radar for Fraud Teams fee. Our calculator considers all of these factors.*

Compare Stripe and Airwallex fees in Hong Kong

Overall, Airwallex offers lower pricing on domestic and international card payments.

Note on FX fees: Businesses can avoid a 2% FX conversion fee and forced currency conversions by settling payments like-for-like (e.g. SGD to SGD). Airwallex offers like-for-like settlement for 14+ major currencies into its multi-currency account at a 1% fee, with no need to set up separate foreign bank accounts. In comparison, Stripe offers like-for-like settlement for USD payments only. Stripe also charges a higher fee of 1% or more, and requires businesses to set up a separate USD bank account to settle payments in USD.

Compare Stripe and Airwallex features

Expand globally with access to more local payment methods

With Airwallex, businesses can expand their global reach with access to 160+ local payment methods compared to Stripe's 100+. These include digital wallets, such as Google Pay and Apple Pay, BNPL options like Klarna and Afterpay, and local bank transfers like Trustly in Europe and iDEAL in the Netherlands. Airwallex also offers 20+ local payment methods in Asia not offered on Stripe, including DOKU Wallet in Indonesia, Toss Pay in South Korea, and ShopeePay in Malaysia.

See all of our 160+ local payment methods.

What local businesses are saying about Airwallex

"Airwallex helped us streamline the entire process, enabling us to keep track of our finances in a glance, without having to connect to another account to see our customer payments."

Kelvin Ko

Managing Director, Travel Expert

"Airwallex’s Klarna plugin completely solved our problems. From initial setup to deployment, the process took less than a week, perfectly aligning the speed that eCommerce requires."

Benjamin

Founder of Grams(28)

"Airwallex's integration with our Shopify online store was simple plug-and-play. We're now able to offer local payment methods to our customers to improve conversions."

Wil Fang

Founder of Cookie DPT

Frequently asked questions about Stripe fees

How much are Stripe fees in Hong Kong?

Stripe typically charges a flat rate of 3.40% + HK$2.35 per successful transaction for domestic card payments and 3.90% + HK$2.35 for international card payments in Hong Kong. Fees vary by merchant location, transaction volume, payment method, shopper currency, transaction type, settlement currency, and payment gateway. Additional fees apply for foreign currency settlement and FX conversions. Airwallex offers a competitive alternative with transparent and often lower fees, especially for businesses dealing with multiple currencies and regions.

How accurate is the Stripe fee calculator?

Our Stripe fee calculator is generally accurate for estimating most transaction processing fees using Stripe. It currently supports Visa and Mastercard schemes and seven major merchant entity locations, including the US, UK, and EU. For more information on Stripe’s fees for other currencies and payment methods, please see Stripe’s website.

What alternative solutions to Stripe are there?

There are several alternatives to Stripe, including PayPal, Square, and Braintree. However, Airwallex stands out for its competitive pricing, like-for-like settlement, multi-currency support, and end-to-end solutions including payment acceptance, FX and transfers, and spend management tools. The Stripe fee calculator can help businesses compare costs and see how much they can save with Airwallex.

What is like-for-like settlement?

Like-for-like settlement is a process that ensures that the currency a business receives in their account is the same as the currency in which the payment was made. This means that if a customer pays a business in, for example, US dollars (USD), the funds will be settled directly into their Airwallex account in USD, without currency conversion. This approach helps businesses avoid unnecessary foreign exchange fees and ensures that they receive the exact amount they are owed, making international transactions more transparent and efficient.

Sign up online, or get in touch with us today

*The Stripe fee calculator is intended to help businesses compare general payment processing costs between Stripe and Airwallex, and is not exhaustive of all currencies, payment methods, and fees, such as dispute fees, chargeback fees, and instant payout fees. Note that Stripe’s Radar for Fraud Teams fee is available only for Stripe accounts with all payment methods on standard pricing. The calculator currently supports Visa and Mastercard schemes, and seven major merchant entity locations: Australia, the European Union, Hong Kong, New Zealand, Singapore, the UK, and the US. The calculator only shows blended pricing and excludes volume-based discounts and custom pricing tiers for enterprises. For simplicity, this model assumes that international sales are transacted in a foreign currency and converted to your home currency. It also assumes that domestic sales occur in your local currency.

All comparisons and information reflect Airwallex’s own research using public documentation as of May 2025, and have not been independently validated. The calculator is not intended to be relied on for the purpose of making a decision about a financial product.