Airwallex Borderless Multi-currency cards for your business

HK businesses can enjoy up to 5% cash rebates on eligible local and international card spend, create free virtual cards for your business in minutes and start transacting in 140+ currencies today.

Empower your business to save on every transaction

Issue FREE cards instantly for employees

Create virtual cards online and start transacting in 140+ currencies.

Save on global expenses

Pay with your multi-currency balance and start saving on international transaction & FX.

Stay in control of team budgets

Track spend in real-time to monthly or total spend limits so you're always on budget.

Save time and money, so you can focus on growth

Create employee cards instantly online

Instantly create and activate virtual employee cards virtual cards so you can make necessary purchases right away with Apple Pay.

Save on ads spend & SaaS subscriptions in foreign currencies

Stop paying hidden bank fees & reinvest the additional 3% international transaction fees into growth.

HK SME Initiative 5% cash rebates for eligible businesses

Earn 5% cash rebates on eligible card spend and enjoy $0 international transaction fees on overseas spending.

Regain control and visibility of team budgets and software subscriptions

Virtual cards that scale with you

Create a dedicated virtual card for each expense category or subscription to better track, manage or freeze spend.

Flexible limits for each card

Set flexible daily, monthly or transaction limits to help your team track to budget and limit risk of unexpected purchases.

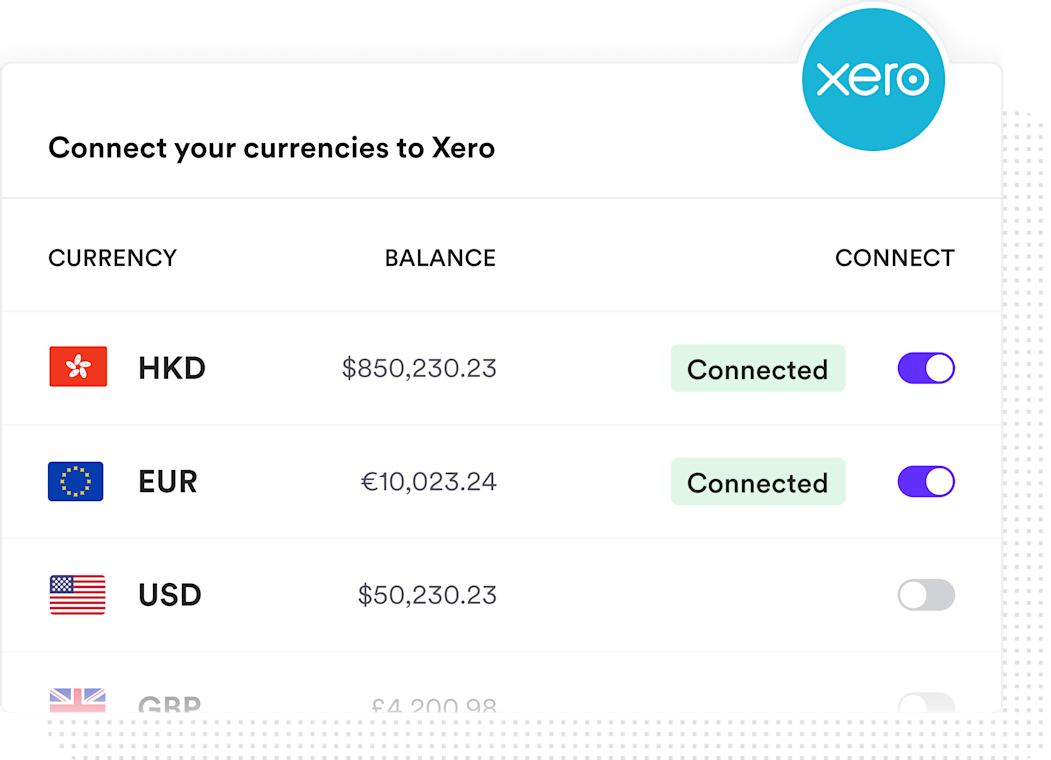

Real-time visibility of global expenses

Sync expenses into Xero, including who made the transaction and where.

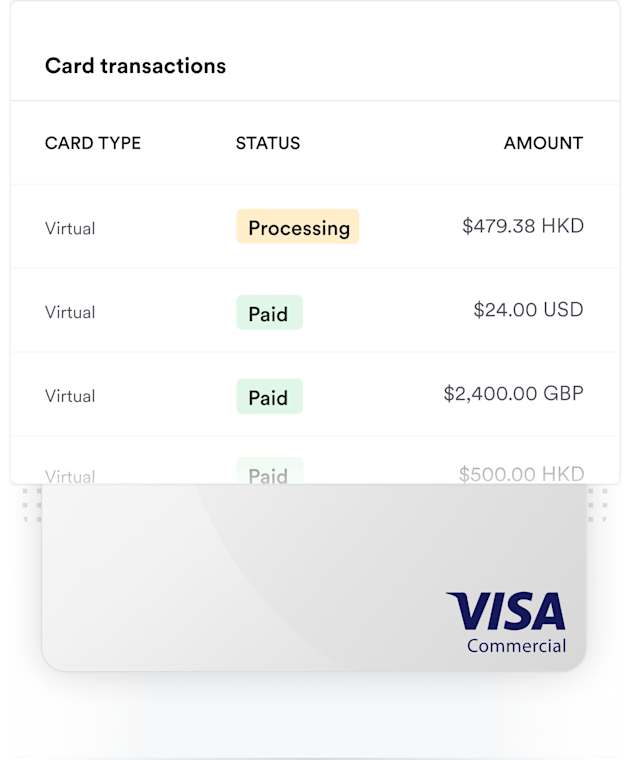

Retain card payment visibility and control

A complete view of card activity

Maintain full visibility of team spending. Control approved currencies, spending limits and allowed merchant types.

Track all your purchases

Set spending limits and controls. Plus, create custom approval workflows to reflect your company spend policy.

Manage your cards online

Make changes to corporate card spend limits, temporarily freeze cards, or revoke card access, all from our online platform.

Save time on accounting with an Airwallex account

Quick and easy integration

Link Airwallex to your Xero account with just a few clicks.

Multi-currency transaction syncing

Automatically sync your multi-currency transactions to Xero, spend less time on tedious data entry.

Syncs hourly

Ensure your Xero transaction records are up to date for your accountant or bookkeeper.

What is a multi-currency card?

A multi-currency card allows users to make payments in multiple foreign currencies from held balances in an associated account. It can be used to pay for goods and services whereever traditional credit and debit cards are accepted online.

Airwallex Borderless Cards are issued by Visa and can be used whereever Visa payments are accepted.

Opening an Airwallex Account

Who is eligible to open an Airwallex account?

Only businesses can apply for an Airwallex account.

How long does it take to open an Airwallex account?

It will take you less than 15 minutes to complete our online application and submit all required business verification documents. In general, your account will be activated in 7-10 business days after your documents have been submitted. In the event of a missing document, our team will contact you by email to request additional information.

Once my Airwallex account has been activated, will I be able to earn cash rebate straight away?

If you are a NEW Airwallex customer - you will receive an SME Initiative invitation email on the day of account activation. Please submit the application form and enrol your company in order to earn cash rebates. You shall receive a successful registration email within 2 working days after submission.

If you are an EXISTING Airwallex customer - you will receive an SME Initiative invitation email. Please submit the application form and enrol your company in order to earn cash rebates. You shall receive a successful registration email within 2 working days after submission. If for any reason you are not able to find the invitation email, please reach out to your Account Manager for the enrolment link.

Applying for 5% Cash Rebate for Marketing and Logistics

How do I apply to get 5% cash rebate?

You will receive an application link by email once your account has been activated. If you have any questions, please contact your assigned product specialist and they will assist you with your application.

How much cash rebate can I earn in this promotion?

All successful applicants will receive a 5% cash rebate (cap at HK$500 per month) on selected merchants for up to four months. For more details, please refer to our T&Cs here.

How long does it take to complete the online application?

Less than 3 minutes. We just need a few more details from you, no further business verification documents will be needed at this time.

How do I know if my application is successful?

The average application processing time is around 5 business days. Upon successful application, you will receive a confirmation email.

Who is eligible to earn 5% cash rebate?

This offer is open to most businesses in Hong Kong. For compliance reasons, we will not be able to onboard companies in the prohibited industries. For more details, please visit here.

I only sell my products outside of Hong Kong. Can I apply for the 5% cash rebate?

Yes. You can apply for it as long as you are an operating business in Hong Kong with a valid Hong Kong Business Registration and a proven operations record in the last 12 months. Your business should sell products or services that do not fall under the prohibited list. Click here for more details.

See how our customers are finding Airwallex

“The 1% extra on every business travel expense used to add up. With Airwallex, I can skip those frustrating foreign transaction fees.”

Rachel Lim

Co-Founder, Love, Bonito

"Airwallex has been a game changer for all our banking needs. As a fast-growing startup, we need a scalable yet cost-efficient batch payment solution to pay our employees and vendors both inside and outside Hong Kong. Airwallex helps us save money on every bank transfer with their near-zero transaction fee and market-beating FX rates. We also use Airwallex’s multi-currency Visa cards for business travel expenses and SaaS subscriptions to avoid hidden bank fees that would otherwise have been difficult to spot. Would highly recommend other startups to get started with Airwallex!"

Henson Tsai

Founder, SleekFlow

“Through Airwallex, Jakewell can easily create Visa Corporate Cards for their team in minutes. Management can set spending limits and assign specific uses for each card to avoid misuse, while the team can quickly handle unexpected expenses. All transactions are automatically recorded, making the reconciliation process a breeze.”

Phyllis

Head of Digital Operations at Jakewell

"I’m so thankful that Airwallex exists! In Hong Kong, it's so hard to find financial service providers that are friendly to small businesses. Airwallex allows me to exchange currencies at really great rates, and the interface is very modern and easy to use compared to my bank. We save so much money with Airwallex! In just a few months, we've already saved more than HK$78,000 in unnecessary fees!"

Jennifer Chong

CEO, Linjer

“To ensure that marketing teams across each market have sufficient funds for daily operations, such as ad placements, KOL payments, and software subscriptions, Grams(28) conducts cross-border transfers on a daily basis. Through Airwallex, we can now easily create employee cards for various teams with just a few clicks.”

Benjamin

Founder of Grams(28)

“Importing the best wine and sake overseas always involve extra costs on transaction fee & FX fee. With Airwallex, we saved 100% of our overseas remittance cost and we could provide the best price for our customers.”

Tomy Wu

Co-Founder, MyiCellar

More than just payment cards

Global accounts

Open international currency accounts

Receive payments in EUR, USD, AUD & GBP via direct deposit. Get started in minutes.

View Global Accounts

API PRODUCTS

Integrate with our APIs

Offer our powerful set of financial features to your customers or integrate Airwallex with your existing workflows.

View API

Borderless Cards

Grab a card

Need to make card payments? Easily create virtual cards on our platform.

view Borderless Cards

Payments & FX

Make payments

Make fast payments in 26+ currencies with low fees and competitive exchange rates.

View payments

You don't need a bank to run your business

Start winning new markets today. Open an account in minutes, and join thousands of businesses already using Airwallex to streamline their finances globally.