Hong Kong companies that operate sales channels in Australia have the need to send funds from Australia to Hong Kong on a regular basis. Although Australia's regulations on remittances are not particularly stringent, relying on traditional banking methods for AUD conversion and transfers can lead to significant transaction fees and unfavourable exchange rate discrepancies, thus increasing the overall remittance costs. As a result, many businesses are turning to e-wallets or third-party remittance platforms for their transactions. The following sections will analyze the characteristics of various methods for money transfers from Australia to Hong Kong.

3 common methods to transfer from Australia to Hong Kong

Bank wire transfers: Businesses can directly send funds from Australia to Hong Kong via bank wire transfers. Overseas banks use the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system to facilitate transactions on behalf of the remitter. Therefore, remitters are required to provide detailed information to their banks, which includes the SWIFT code, the receiving bank’s name and address, the account holder's name and number, and the details of any intermediary bank involved (if applicable).

E-transfers or remittances through online banking: Businesses can also use online banking for self-service wire transfer from Australia to Hong Kong. Similar to the traditional bank wire transfer, the remitter still needs to provide various detailed remittance information, yet this method may circumvent the handling fees typical of in-branch transactions. Additionally, businesses can opt for e-wallets that support international remittances. Platforms such as PayPal, for instance, allow businesses to connect their local bank account or credit card to top up the e-wallet, enabling them to subsequently transfer money to recipients in other countries or regions.

All-in one financial platform: Remittance platforms are generally run by large multinational institutions, such as Western Union, Wise, and more. Users simply enter the desired amount and currency, and the platform generates a quote automatically. With confirmation, the platform initiates the transfer from the Australian account to the Hong Kong account. Also, the all-in-one financial platform Airwallex allows opening a virtual AUD Global Account, which is similar to owning a local bank account in Australia. It allows users to directly receive funds in local currency in Hong, and carry out transfers without needing to switch currencies. Furthermore, remitters also benefit from favourable mid-market rates when converting the funds into Hong Kong dollars.

3 things to consider before transferring funds from Australia to Hong Kong

When choosing a service provider for transferring money from Australia to Hong Kong, it is best to consider the processing time, the associated fees, and available payment methods offered by the provider. Here are the details:

Processing time: Bank wire transfers typically take about 5 business days to complete, although the actual duration can vary by bank. However, it's important to note that some banks process wire transfers only during specific hours, so any transfer initiated outside these times will be postponed to the next business day. For digital e-transfer platforms like PayPal, funds are instantly credited to the recipient’s digital wallet. Transferring funds from PayPal to a local bank account may take 3 to 6 days. The processing time for payment platforms depends on the payment method. For Airwallex, funds can be credited within just one business day.

Remittance fees: Typically, transaction fees for wire transfers are waived when using an AUD account from a local bank. However, to profit from the transaction, banks set an exchange rate that exceeds the mid-market rate. Moreover, intermediary banks and receiving banks might also impose their own charges. Large transfers or transactions done through a branch may incur additional or hidden fees. It is recommended to understand the total cost associated with all fees prior to the transfer. On the other hand, remittance platforms generally charge a fee based on a percentage of the transfer amount. For example, all-in-one financial platform, Airwallex, offers international remittance services with no transaction fees for 90% of the transactions, and are completed through local rails. Lastly, PayPal employs a more complex fee structure.

Payment and receipt methods: To initiate wire transfers at a local bank, remitters must possess an account in the respective country. For each transaction, the bank transfers the funds from the sender’s Australian bank account to the recipient's account in Hong Kong. Conversely, when utilising online remittance services, it's crucial not only to set up accounts on the platforms but also to understand the payment methods available. Typically, these platforms accommodate both bank transfers and credit card payments.

Comparing the 3 common methods to transfer from Australia to Hong Kong

| Wire transfers via banks | E-transfer platforms | Airwallex | |

|---|---|---|---|

| Handling fees | Fees are charged on a per-transaction basis. Major banks of Australia allow wire transfers from their Australian dollar accounts to Hong Kong without charging any transaction fees. However, intermediary banks and the receiving bank may still impose fees for the transfer. | Basic exchange rate plus handling fees | $0 transaction fee, and charges only low percentage above the interbank rate for currency conversions |

| Processing time | Within 5 business days | 3 to 6 business days | As fast as within 1 business day |

Comparison between Airwallex and traditional banks

Commercial remittances prioritise speed and affordability, presenting benefits across both local bank transfers and e-transfer platforms. Australian accounts eliminate transaction fees involved when sending funds through an Australian account at the local bank. Yet, these banks often apply exchange rates with higher margin than market rates, and may entail hidden costs from intermediary banks and receiving banks, resulting in higher costs overall.

Airwallex offers a secure, fast, and transparent solution for transfer services with no hidden fees. The platforms support over 60 currencies to more than 150 countries and regions, including USD, GBP, CNY, EUR, JPY, KRW, and more.

Regarding processing time, bank transfers usually involve intermediary banks, which takes longer than local transfers. Depending on cutoff times, it might take up to five business days for funds to be credited. Conversely, Airwallex Business Account makes international remittances as easy as local transfers – funds can be credited as fast as within 1 business day.

How is Airwallex’s exchange rate more favourable?

Airwallex offers a market-leading favourable exchange rate for currency conversions. Business Account holders can transfer without minimum transaction requirements, remittance fees or intermediary bank charges. Moreover, funds can be credited as fast as on the same-day, free from any hidden charges or additional fees.

Steps and procedures of money transfer from Australia to Hong Kong using Airwallex

Experience seamless fund collection from Australia to Hong Kong using Airwallex by following the instructions provided below.

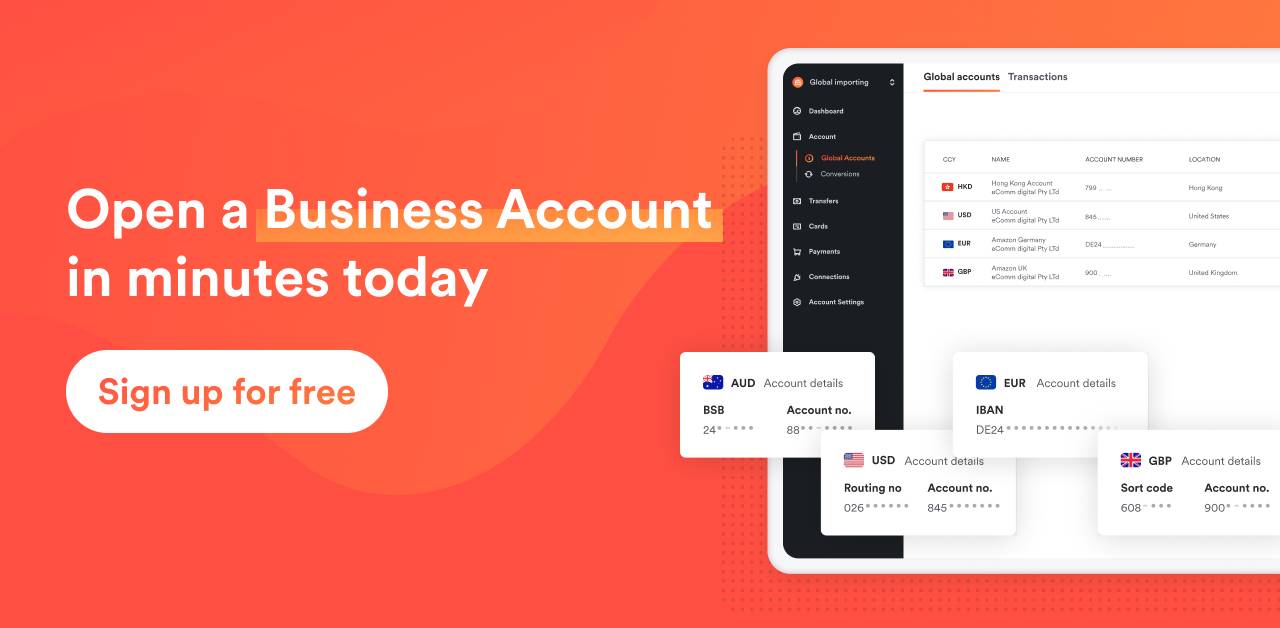

Create an account: To create an account, simply enter your name, business email, and password. Your account will be activated immediately.

Identity Verification: Verify the identity of your business and the applicant. First, provide the details of your business and upload relevant documents. Then, fill in information related to your business, such as the industry type, products offered, revenue figures, and the scope of operations.

Open Global Accounts: Select the location and required currency to open a Global Account. You are now ready to collect transfers from Australia in your preferred account currencies.

Benefits of using Airwallex to receive remittances from Australia to Hong Kong

Having an Airwallex virtual AUD Global Account is similar to owning a local bank account in Australia. It allows users to directly receive funds in AUD. Making payments to local suppliers and employees in AUD, significantly reduces currency conversion costs.

Are there any restrictions on money transfer from Australia to Hong Kong?

Australia does not enforce capital control measures, so there are no restrictions on money transfers from Australia to Hong Kong. Individuals and businesses are free to transfer funds to Hong Kong. However, similar to other countries, banks, remittance platforms, and financial institutions may ask remitters to provide compliance documents. These can include proof of income, the transaction's purpose, and other trade-related documents.

FAQs

1. Is it necessary to have a local bank account in Australia in order to send funds to Hong Kong?

It is required to have a local bank account in Australia if you choose to send funds to Hong Kong through bank wire transfer. If you opt for Airwallex or e-transfer platforms, you may create virtual accounts and a local bank account in Australia is not necessary.

2. What kind of information is required in order to remit funds from Australia to Hong Kong?

Remitters are required to provide detailed information about the recipient, whether it is an individual or a business. This includes the recipient's full name and address, the full name and address of the receiving bank, the International Bank Account Number (IBAN) or bank account number, and the SWIFT code or the bank identification code (BIC).

3. Can money transfers from Australia to Hong Kong be done without incurring any transaction fees?

Local banks charge approximately USD 18 to USD 30 (approximately HK$140 to HK$234) for wire transfer from Australia banks to Hong Kong. Generally banks will profit from the exchange rate difference and additional fees may be charged by intermediary banks and also the receiving bank when transferring funds to Hong Kong. Through Airwallex, 90% of transactions are completed through local rails bypassing SWIFT to save FX fees.

4. Is Airwallex an instant transfer service? How many days does it usually take to complete a payment?

Funds can be credited as fast as within 1 business day. With Airwallex Business Account, remitters can choose the desirable transfer rail according to their needs More than 70% of transfers are completed within a few hours, and 50% of them are instant.

View this article in another region:Hong Kong SAR - 繁體中文

Kirstie Lau

Brand Content Marketing Manager

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

Posted in:

TransfersShare

- 3 common methods to transfer from Australia to Hong Kong

- 3 things to consider before transferring funds from Australia to Hong Kong

- Comparing the 3 common methods to transfer from Australia to Hong Kong

- Comparison between Airwallex and traditional banks

- How is Airwallex’s exchange rate more favourable?

- Steps and procedures of money transfer from Australia to Hong Kong using Airwallex

- Benefits of using Airwallex to receive remittances from Australia to Hong Kong

- Are there any restrictions on money transfer from Australia to Hong Kong?

- FAQs