Business account: What it is, advantages, and process of account-opening

Kirstie Lau

Brand Content Marketing Manager

What is a business account?

A business account is a bank account opened in the name of the company for financial transactions. It is essential for managing day-to-day business receipts, payments, and financial reporting. This account maintains a clear record of business transactions, simplifying tax filings and expense management for an organisation. Having a dedicated business account ensures accurate accounting and a clear separation between personal and business finances.

If you are searching for what a business account is, the advantages, potential limitations, and requirements for opening one, this article will offer you a thorough explanation.

What are the types of business accounts?

Traditionally, there are separate types of business accounts to suit different needs, such as savings accounts, payroll accounts, and investment accounts. Yet, modern financial solutions are transforming the landscape by combining multiple business account functions into a single, integrated platform. Alternatively, with an Airwallex Business Account, businesses can manage daily transactions, convert currencies, make international payments, issue Corporate Cards, and handle payroll and expenses – all from one account, making it easier to manage multiple financial activities without juggling separate accounts.

Benefits of opening a business bank account

Opening a business bank account offers myriad advantages that can significantly enhance financial management and the growth of a company. Here are some key features of a business bank account:

Separates personal and business finances to reduce the risk of commingling funds: A business account allows for clear separation between personal and business finances, ensuring transparency and accuracy in liquidity and financial records. The risk of being flagged or frozen with large transfers is also much lower compared to a personal account.

Provides a clear record of business transactions, making it easier to manage business expenses: Business accounts provide accurate and comprehensive financial records, including income, employee payrolls, and transaction details. This clear record not only simplifies the process of monitoring cash flow, but also streamlines tax filing and financial reporting.

Offers business banking services: In addition to basic banking functionalities, such as deposits and withdrawals, business accounts often come with specialised services tailored to business needs. These services may include bulk payroll processing, dedicated accounting support, and access to business loans or lines of credit, all of which can bolster operational efficiency and financial stability.

Builds business credit and establishes business reputation: A business bank account is instrumental in building a strong financial foundation for the company. Consistent and responsible banking activities can help in building business credit, which is essential for securing favourable loan terms and establishing a positive business reputation within the financial ecosystem.

Manages foreign exchange and international transactions: A business bank account simplifies the management of foreign exchange and international transactions. Dedicated business accounts often offer competitive exchange rates, streamlined transaction processes, and specialised customer support services.

What are the complications in opening business bank accounts?

Opening a business bank account is not always a straightforward process. We have outlined a couple of the common challenges so your business can prepare in advance and choose the best banking option that suits your needs.

Complex background checks: Financial institutions are obligated to conduct thorough due diligence to verify the legitimacy of businesses and ensure compliance with regulatory standards. This scrutiny involves a detailed examination of the business's financial history, ownership structure, and operational practices, often leading to a time-consuming and meticulous review process.

Complex Know Your Customer (KYC) process: KYC is a necessary step for banks to verify the customer's identity and examine the details in order to comply with the Anti-Money Laundering and Counter-Terrorist Financing Ordinance. While it benefits both the bank and the customer by reducing the risk of fraud and illegal activities, it adds another layer of complication.

Requirements of business proofs, especially for startups: Opening a business account usually requires proof of business operations and financial documents. It is challenging for banks to assess credit risks for startups or SMEs with limited operating history, funding, and a lack of credit history and financial data.

Challenges in opening business accounts for different types of businesses

Different business structures face unique challenges when meeting bank requirements. From providing the right documentation to navigating industry-specific regulations, businesses often encounter obstacles that can delay or complicate the process. The following section highlights the common barriers faced by startups, short and medium enterprises, and foreign companies when opening business accounts.

Startups

Maintaining minimum balance requirements can be tricky for startups with tight operating budgets. With a short operating history, fluctuating cash flows, and uncertain business prospects, startups may struggle to demonstrate financial stability and meet the stringent criteria set by financial institutions. These factors can result in increased scrutiny during the account opening process and make it harder for startups to access the necessary financial services to support their growth and development.

Small and medium enterprises (SMEs)

Limited financial resources and operational scale often make it challenging for SMEs to meet the minimum balance requirements set by banks. With varying legal structures, SMEs often need to provide proof of registration, tax identification numbers, and ownership details, which can be complex if the business has multiple stakeholders or a non-standard setup. The lack of an established credit history and financial documentation can also hinder their ability to qualify for business accounts, leading to potential rejections or restrictions on banking services.

Foreign companies

Opening a business account as a foreign company presents several challenges, primarily due to regulatory, legal, and banking requirements. Due to anti-money laundering regulations, banks require extensive documentation, including company registration certificates, proof of business activities, director identification documents, and more. These requirements vary by country, making the process complex.

Another challenge is the lack of a local presence or address. Many banks require a local office, representative, or even a resident director. If the company does not have a physical presence, some banks may refuse to open an account. Additionally, some jurisdictions require a local tax identification number, which adds another layer of complexity.

Banking policies and restrictions on foreign entities also pose difficulties. Some banks are hesitant to work with foreign businesses due to perceived risks. High-risk industries, such as fintech or cryptocurrency, face even stricter scrutiny. Moreover, there may be high fees, minimum deposit requirements, and additional administrative costs that make account opening expensive.

Language barriers, bureaucratic delays, and changing financial regulations further complicate the process. In some cases, companies must work with legal or financial consultants to navigate these challenges, increasing the overall cost and effort required.

What are the options to open a business account?

While traditional banks remain a common choice for business bank accounts, alternative solutions like Airwallex provide a modern, cost-effective way to manage business finances globally. The table below outlines different options available, along with their unique features and advantages.

| Traditional banks, e.g. HSBC and Hang Seng Bank | Virtual banks, e.g. ZA Bank and livi Bank | Airwallex Business Account |

|---|---|---|---|

Account opening fees | Yes, but some offer fee waivers | Yes, but some offer fee waivers | None |

Process time | Usually 3–5 days | Usually 1–3 days | As fast as 48 hours |

Account opening method | In-person or online | Online | Online |

Minimum balance requirement | Yes | Lower or none | None |

How to open a business bank account?

Documents required

Documents required for opening a business account may vary depending on the bank and types of business accounts. However, regardless of whether it is a sole proprietorship or a partnership, these documents are essential to verify the company's legality and identity.

Proof of company registration, such as the Business Registration Certificate (BR) or Certificate of Incorporation (CI)

Proof of address

Identification documents (e.g. passport, ID card) for shareholders, board members, and authorised signatories.

Company search fee (may be required by some banks)

Existing business transaction records (may be required by some banks), such as invoices, purchase and logistics orders, lease agreements, contracts, etc.

Steps for opening a business bank account

Choose a bank or provider: Choose a suitable bank or financial provider that aligns with your business needs. Research different banks, comparing their offerings, and considering factors like fees, account features, and accessibility to make an informed decision.

Prepare the supporting documents: Gather the necessary supporting documents required for opening a business account. Ensure that all documents are accurate and up-to-date to expedite the account opening process.

Submit your application or make an appointment: Submit your application either online, in person, or by making an appointment with a bank representative. This step initiates the account opening process.

Go through the KYC process: The bank verifies your identity and assesses potential risks associated with your business activities. This step is essential for regulatory compliance and fraud prevention.

Activate your account: After completing the necessary checks and approvals, you can activate your account and start using the banking services provided. This typically involves depositing an initial amount into the account and setting up any additional services or features that you may need for your business operations.

How long does it take to activate your business bank account?

In general, major traditional banks take one to three business days and up to a couple of weeks to complete the opening of a business account. For example, HSBC Hong Kong takes a minimum of three business days, Standard Chartered Hong Kong takes a minimum of two, and Hang Seng Bank takes a minimum of three to five.

The timeline for account activation can vary depending on factors such as the completeness of the application, the complexity of the business structure, and the bank's internal processes. Delays may occur if additional information or clarification is needed from the business owner or if there are discrepancies in the provided documents.

How to choose the right business bank account for your business?

Here are several crucial factors that should be considered to ensure the chosen business account aligns with your business requirements and financial goals.

Business account fees and charges

Account fees may include monthly maintenance fees, transaction fees, overdraft charges, and other service charges. Each bank has its own minimum deposit requirements for opening a business account. In general, the monthly fee will be waived if the minimum balance is met, or a monthly fee of HK$150 to HK$200 will be charged.

Hidden fees

Businesses should be wary of hidden fees that can significantly impact the overall cost of maintaining the account. These hidden fees could include charges for paper statements, ATM withdrawals, wire transfers, or minimum balance requirements. Thoroughly reviewing the terms and conditions of the account agreement can help in identifying and avoiding unexpected charges.

Minimum balance requirements

Minimum balance requirements vary depending on banks and account types*. For instance, HSBC Hong Kong offers three types of business accounts:

HSBC Sprint Account – Dedicated for startups, with a minimum initial deposit of HK$10,000. Service fees are waived for the first year. Account holders can continue to enjoy the monthly service fee waiver from the 13th month after account opening if the previous 3 months’ average total balance is at HK$50,000 or above.

HSBC Business Direct – Suitable for growing small and medium-sized enterprises (SMEs) that are just starting out and prefer banking without personally visiting the branches. The minimum initial deposit is HK$10,000, and the monthly service fee is waived if the previous three months’ average total balance is at HK$100,000 or above.

BusinessVantage – Also suitable for well-established SMEs, with an average total minimum deposit of HK$500,000 or above. in the previous three months’ in order to waive the monthly service fee.

Hang Seng Bank offers two types of business accounts:

Biz Virtual+ Account – Best for startups and local SMEs. Service fee is waived for the first year, and the Total Relationship Balance must be HK$50,000 or above from the 13th month onwards.

Integrated Business Solutions Account – Suitable for stable growing businesses. The Total Relationship Balance requirement is HK$100,000 or above.

Bank of China (Hong Kong) offers three types of business accounts and fee waivers are offered for meeting the following conditions:

Business Integrated Account – Elite: Total Relationship Balance of HK$1 million or above

Business Integrated Account – Plus: Total Relationship Balance of HK$200,000 or above

Business Integrated Account – Total Relationship Balance of HK$50,000 or above

*As of 18 June 2025. Information provided is for reference only. Please refer to the official bank websites for the most up-to-date details.

Payment transactions duration

Timely and efficient processing of payments is vital for maintaining cash flow and meeting financial obligations. Understanding the payment processing timelines, cut-off times for deposits, and availability of funds can help in selecting an account that facilitates seamless and timely transactions for your business operations.

Which business account is suitable for a small business?

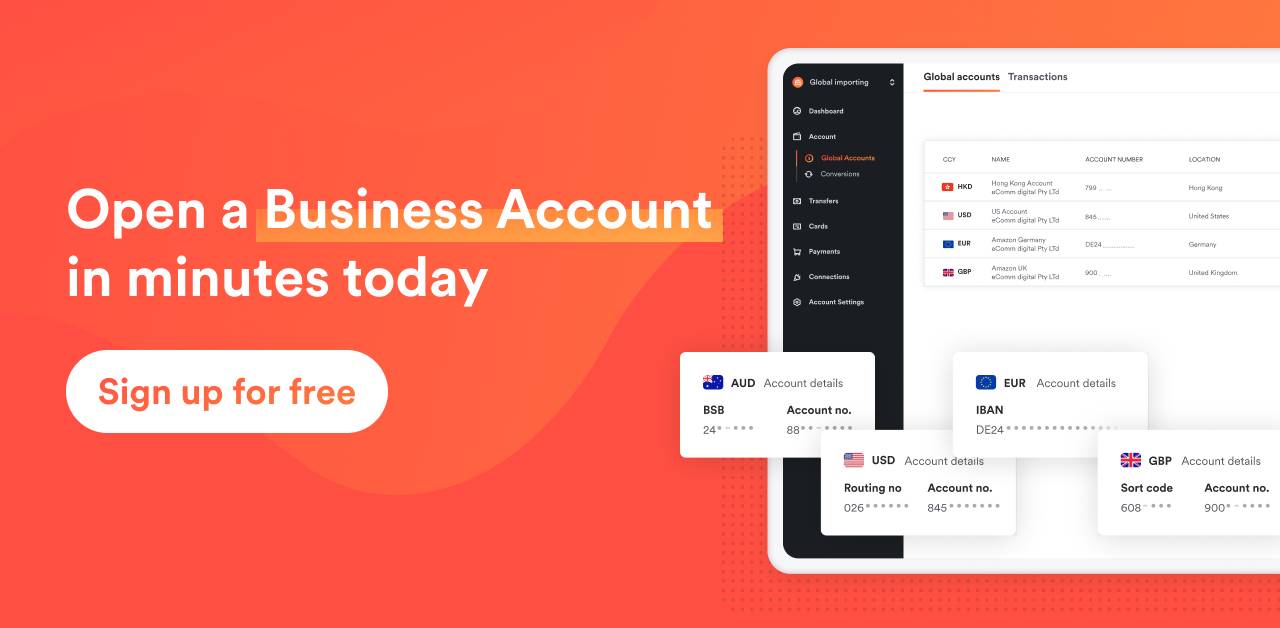

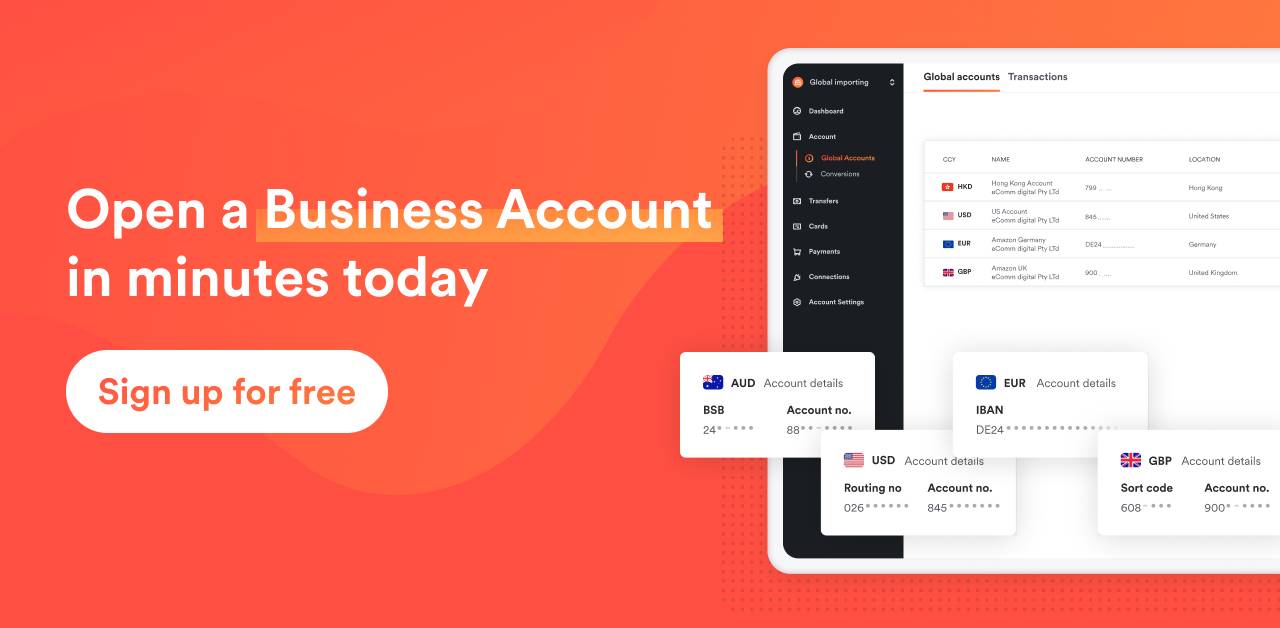

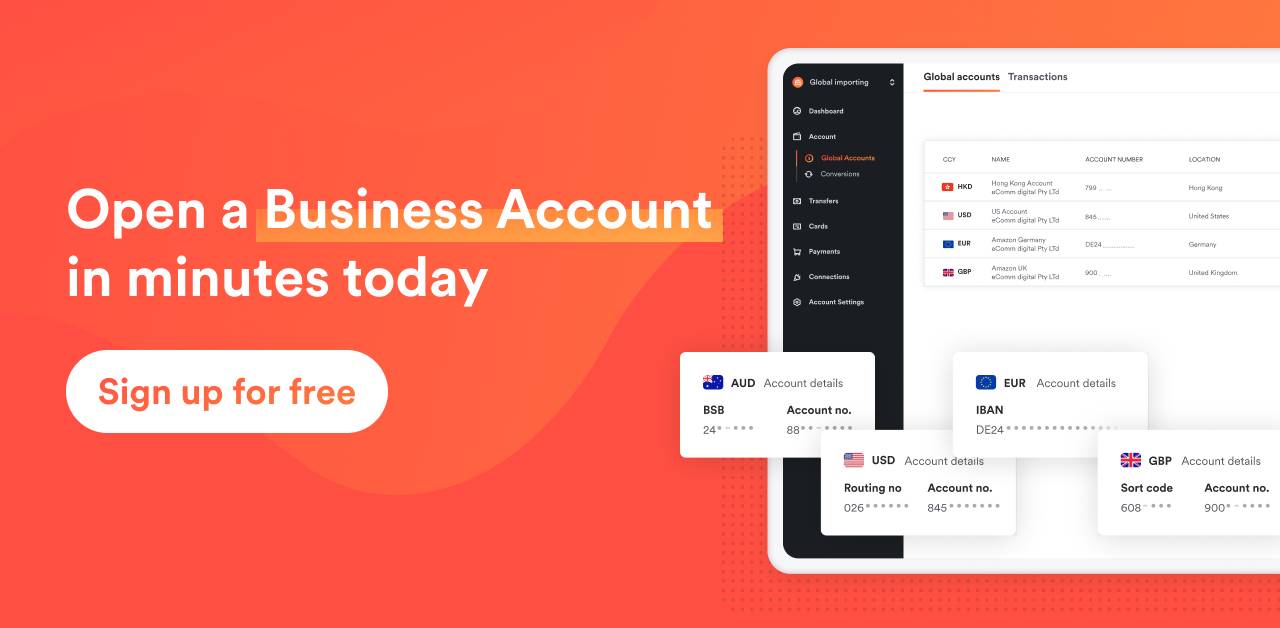

The all-in-one financial platform Airwallex offers Business Accounts with no account opening fee, and there is no requirement on minimum balance. Businesses can easily sign up for a business account anywhere, anytime through our website, eliminating the need to wait in bank queues and go through complicated application procedures. Account opening processes are typically completed within 48 hours. This account opening process not only ensures efficiency but also offers unparalleled convenience, perfect for SMEs.

For companies that require cross-border transfers, Airwallex's FX & Transfers allows businesses to make transfers to over 200 countries with real-time rates as low as 0.2% above interbank rates. You can also receive payments directly in your local currency and save on international payments with our local network in 120+ countries. Payments can be settled in as quickly as one business day.

The Airwallex Corporate Cards simplifies business expense management by allowing your employees to upload receipts and reimburse expenses through the Airwallex mobile app. Additionally, Airwallex facilitates integration with leading accounting software such as Xero, NetSuite, and QuickBook. Businesses can streamline financial management, enhancing overall efficiency and accuracy in record-keeping.

View this article in another region:AustraliaCanada - EnglishCanada - FrançaisChinaHong Kong SAR - 繁體中文New ZealandSingaporeUnited KingdomUnited States

Kirstie Lau

Brand Content Marketing Manager

Kirstie Lau is a fintech writer at Airwallex, and has built up a wealth of knowledge in financial operations systems. In her day-to-day, she dedicates herself to crafting content that fits the unique needs of businesses seeking financial operations solutions. Kirstie’s background in analytics and product marketing gives her a unique perspective on guiding businesses through the complex world of payments.

Posted in:

Business bankingShare

- What is a business account?

- Benefits of opening a business bank account

- What are the complications in opening business bank accounts?

- Challenges in opening business accounts for different types of businesses

- What are the options to open a business account?

- How to open a business bank account?

- How long does it take to activate your business bank account?

- How to choose the right business bank account for your business?

- Payment transactions duration

- Which business account is suitable for a small business?