Canada (CA_EFT_DEBIT)

Before you begin

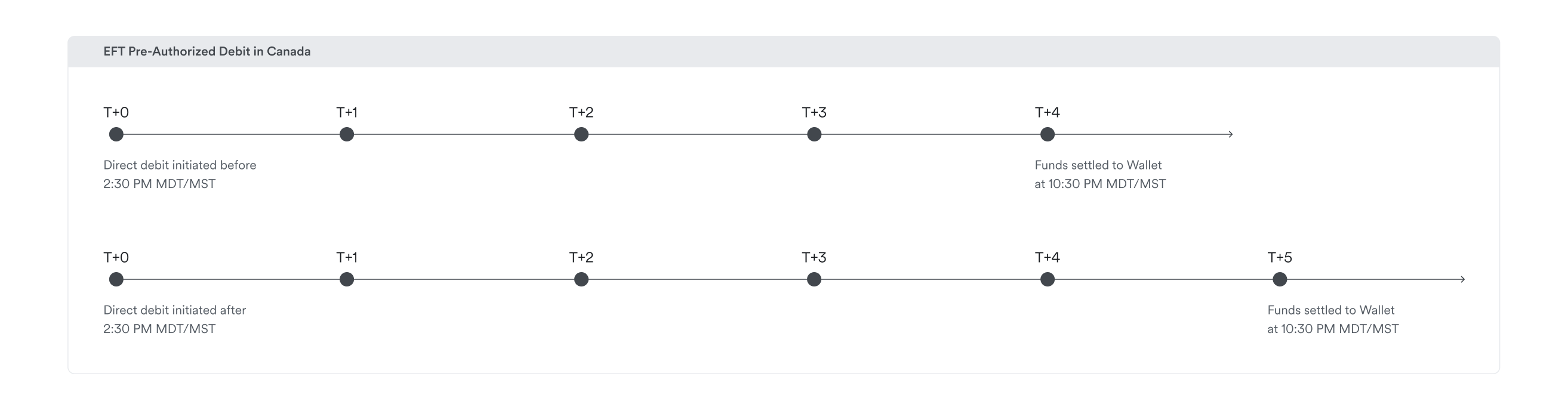

Settlement times

As indicated above, EFT Pre-Authorized Debit (PAD) in Canada takes 4-5 business days to settle, depending on submission before/after the cut-off time. Therefore, we recommend leaving some buffer time ahead of the cut-off to avoid delays.

Customers who wish to accelerate the settlement time may apply for our Faster Direct Debit offering, which offers a shortened settlement time of 1-2 business days, and will settle before 11:30 AM CET. To enable this capability, please contact your Account Manager and confirm our terms, conditions, and fees.

Mandate requirements

To add funds via EFT direct debit, your customers must first link their Canada external bank accounts, as outlined in Linked Accounts.

Before any EFT direct debit is processed, the owner of the external bank account must authorize Airwallex to directly debit the account on your behalf, in compliance with the Payments Canada Rules. A copy of the authorization will be sent by Airwallex via email to the bank account owner, and is stored and made available to be shared with the customer at all times.

The following is a guide to building your native product experience for your customers to link their external bank account and sign the mandate/agreement.

1. Linking an external bank account

The title should clearly inform your customers that they are linking an external bank account to set up direct debit.

You must ask the external bank account owner (or display their previously entered):

- Bank account name

- Bank account number

- Institution number

- Transit number

- Bank account owner email address

2. Confirmation of account details and direct debit authorization

The customers should be given a prompt to confirm that their bank account details are correct before submitting the Linked Bank Account.

The following text must be displayed:

Pre-authorized Debit (PAD) Agreement

Withdrawal Authorization: The Payor ("you”) authorizes Airwallex (Canada) International Payments Limited ("Airwallex”) to initiate debit entries to the account specified (the "Payment Account”), or any other account authorized by you at any institution that is a member of Payments Canada, all in accordance with this PAD Agreement. You confirm that you have authority under the terms of your Payment Account agreement to authorize this debit arrangement. If this PAD Agreement is for a business Payment Account, you confirm that you have the authority to bind the business. By authorizing this PAD Agreement, you acknowledge having received and read a copy of this PAD Agreement, including the terms contained herein; you acknowledge that you understand the terms of this PAD Agreement; and you agree to be bound by the terms of this PAD Agreement.

Waiver of Pre-notification and Confirmation: The Payor waives any and all requirements for pre-notification or confirmation of any and all such debits. Without limiting the foregoing, you acknowledge that no notice is required for the amount of any PAD (if variable) or changes to the amount of any PAD when the debit of such amount or change in such amount occurs as a result of direct action and/or specific authorization by you (for example, as contemplated under the heading "Timing / Specified Event" in Part C above).

Changes to Payment Account: If you change the Payment Account, this PAD authorization will apply to the new account and you shall provide us in writing such information regarding the new account as we deem necessary. Such new account shall thereafter be and become the "Payment Account” for the purpose of this PAD Agreement. It may take us up to 30 business days after receipt of a written notice from you to reflect in our system any change to the Payment Account. If you change the Payment Account, you agree that you are responsible for all costs incurred by us in connection with your decision to change the Payment Account.

Change of Other Information: If you change your email address, physical address or any other profile information, you must promptly update your profile on our website and/or provide us with the updated information. We have no responsibility for notices or other information sent to an incorrect address.

Cancellation of PAD Agreement: You may revoke, change, or cancel your authorization under this PAD Agreement this PAD authorization upon thirty (30) days' prior written notice to us. You may obtain a sample cancellation form, as well as further information on your right to cancel a PAD authorization by contacting your financial institution or by visiting www.payments.ca .

Upon providing a notice of cancellation or revocation of authority or cancellation or termination of the terms of service or any other agreements under which Airwallex provides products or services to you (the "Airwallex Agreements”), Airwallex will cease issuing PADs in accordance with the termination provisions of the Airwallex Agreements and Rule H1 under the CPA.

Recourse/Reimbursement: You have certain recourse rights if any debit does not comply with this PAD Agreement. For example, you have the right to receive reimbursement for any debit that is not authorized or is not consistent with this PAD Agreement. To obtain more information on your recourse rights, you may contact your financial institution or www.payments.ca .

Payment Service Provider: In some cases, we are acting as a payment service provider to a Payee and not as the Payee. In such cases, we will be providing any funds debited from the Payment Account to the Payee pursuant to the terms of the Airwallex Agreements and any agreement we may have with the Payee for our provision of payment services to the Payee.

Contact Us: If you wish to make enquiries, obtain information, cancel this PAD Agreement or seek recourse with respect to any PAD, you may contact us at [email protected].

3. Confirmation of direct debit set up

It is recommended that you provide a confirmation page to your customers at the end of the process to inform them that direct debit has been successfully set up for the Linked Bank Account.

API instructions

1. Create Linked Account with direct debit mandate

Referring to Linked Account requirements for direct debit, both BUSINESS and INDIVIDUAL Linked Account types are supported for EFT PAD in Canada.

Micro-deposit and Open Banking are both available for this scheme. Please follow the instructions in Create a Linked Account and submit the required mandate information under the mandate object.

Example request for Linked Account created using micro-deposit verification

1curl --request POST \2--url 'https://api-demo.airwallex.com/api/v1/linked_accounts/create' \3--header 'Content-Type: application/json' \4--header 'Authorization: Bearer <your_bearer_token>' \5--data '{6 "type": "CA_BANK",7 "ca_bank": {8 "account_name": "Tester Smith",9 "account_number": "89098199202",10 "currency": "CAD",11 "entity_type": "BUSINESS",12 "institution_number": "010",13 "transit_number": "12345"14 },15 "preferred_verification_type": "MICRO_DEPOSIT",16 "mandate": {17 "email": "[email protected]",18 "signatory": "Tester Smith",19 "type": "CA_EFT_DEBIT",20 "version": "1.0"21 }22}'

If you are registered as a platform account, you can call this endpoint on behalf of your customers by specifying the open ID in the x-on-behalf-of header.

Example response

1{2 "id": "1277aa91-b9d7-4a20-998a-87c1a4bad6bc",3 "status": "REQUIRES_ACTION",4 "supported_currencies": [5 "USD"6 ],7 "type": "CA_BANK",8 "ca_bank": {9 "account_name": "Tester Smith",10 "account_number": "89098199202",11 "currency": "CAD",12 "entity_type": "BUSINESS",13 "institution_number": "010",14 "transit_number": "12345"15 },16 "next_action": {17 "type": "verify_micro_deposits",18 "remaining_attempts": 3,19 "micro_deposit_count": 220 },21 "capabilities": {22 "balance_check": false,23 "direct_debit_deposit": true24 }25}

Example request for Linked Account created using Open Banking verification

1curl --request POST \2--url 'https://api-demo.airwallex.com/api/v1/linked_accounts/create' \3--header 'Content-Type: application/json' \4--header 'Authorization: Bearer <your_bearer_token>' \5--data '{6 "type": "CA_BANK",7 "ca_bank": {8 "account_name": "Tester Smith",9 "account_number": "89098199202",10 "currency": "CAD",11 "entity_type": "BUSINESS",12 "institution_number": "010",13 "transit_number": "12345"14 },15 "preferred_verification_type": "PLAID",16 "plaid": {17 "account": {18 "id": "p4aN1gq5MwuAeVv47pkjh63l5K8gV6fJqKepE",19 "mask": "0000",20 "name": "Business Savings"21 },22 "institution": {23 "id": "ins_3",24 "name": "Chase"25 },26 "public_token": "public-sandbox-2a6878ca-0e6b-42cf-ba9b-490401bb5a93"27 },28 "mandate": {29 "email": "[email protected]",30 "signatory": "Tester Smith",31 "type": "CA_EFT_DEBIT",32 "version": "1.0"33 }34}'

If you are registered as a platform account, you can call this endpoint on behalf of your customers by specifying the open ID in the x-on-behalf-of header.

Example response

1{2 "id": "1277aa91-b9d7-4a20-998a-87c1a4bad6bc",3 "status": "SUCCEEDED",4 "supported_currencies": [5 "CAD"6 ],7 "type": "CA_BANK",8 "ca_bank": {9 "account_name": "Tester Smith",10 "account_number": "89098199202",11 "currency": "CAD",12 "entity_type": "BUSINESS",13 "institution_number": "010",14 "transit_number": "12345"15 },16 "capabilities": {17 "balance_check": true,18 "direct_debit_deposit": true19 }20}

If you already have a Linked Account created, you may call Update a Direct Debit Mandate API to create the mandate.

Example request

1curl --request POST \2--url 'https://api-demo.airwallex.com/api/v1/linked_accounts/<your_linked_account_ID>/mandate' \3--header 'Content-Type: application/json' \4--header 'Authorization: Bearer <your_bearer_token>' \5--data '{6 "email": "[email protected]",7 "signatory": "Tester Smith",8 "type": "CA_EFT_DEBIT",9 "version": "1.0"10}'

If you are registered as a platform account, you can call this endpoint on behalf of your customers by specifying the open ID in the x-on-behalf-of header.

Example response

1{2 "accepted_at": "1648387704",3 "email": "[email protected]",4 "signatory": "Tester Smith",5 "status": "ACTIVE",6 "type": "CA_EFT_DEBIT",7 "version": "1.0"8}

2. Create direct debit deposit

Before creating a direct debit deposit, please ensure that you have a sufficient funding limit by checking your available funding limit.

If the Linked Account was created using Open Banking verification, you may use Check available balance API to ensure that the Linked Account has sufficient balance before initiating a direct debit deposit.

Next, follow the instructions outlined in Create a direct debit deposit. Please note that EFT PAD in Canada does not support direct debit deposit reference.

Example request

1curl --request POST \2--url 'https://api-demo.airwallex.com/api/v1/deposits/create' \3--header 'Content-Type: application/json' \4--header 'Authorization: Bearer eyJhbGciOiJIUzI1NiJ9.eyJzdWIiOiJ0b20iLCJyb2xlcyI6WyJ1c2VyIl0sImlhdCI6MTQ4ODQxNTI1NywiZXhwIjoxNDg4NDE1MjY3fQ.UHqau03y5kEk5lFbTp7J4a-U6LXsfxIVNEsux85hj-Q' \5--data '{6 "amount": 12794.27,7 "currency": "CAD",8 "deposit_type": "DIRECT_DEBIT",9 "funding_source_id": "67f687fe-dcf4-4462-92fa-20335321d9d8",10 "request_id": "c559d7fe-d911-4f3d-a937-7c24ba4b732a"11}'

If you are registered as a platform account, you can call this endpoint on behalf of your customers by specifying the open ID in the x-on-behalf-of header.

Example response

1{2 "amount": 12794.27,3 "created_at": "2017-03-20T14:00:01+1100",4 "currency": "CAD",5 "deposit_id": "67f687fe-dcf4-4462-92fa-20335301d9d8",6 "payer_name": "tester",7 "source": {8 "funding_source_id": "67f687fe-dcf4-4462-92fa-20335321d9d8",9 "type": "CA_EFT_DEBIT"10 },11 "statement_ref": "5487287788",12 "status": "SETTLED",13 "type": "DIRECT_DEBIT"14}

Clearing system error codes

To help you handle exceptions systematically, this page provides a comprehensive list of all possible clearing system errors and detailed descriptions when the Linked Accounts or a direct debit deposit from Linked Accounts are in failure statuses.

We recommend using the Airwallex error code or the iso_code for systematic exception handling. The code from provider_failure_details can be used for troubleshooting against the clearing system rules, but it is not advised for systematic handling because the clearing system may update it from time to time.

Linked Account error codes

| code | iso code | provider failure details code | description |

|---|---|---|---|

incorrect_bank_account_information | NARR | NARR | The bank account information specified in the request is incorrect. Please confirm the account information with the payer before contacting your account manager for further information. |

currency_account_mismatch | NARR | NARR | The bank account is unable to receive in this currency. Contact the payer or payer's bank for further information. |

Direct debit deposit error codes

| code | iso code | provider failure details code | description |

|---|---|---|---|

incorrect_bank_account_information | NARR | 900 | The bank account information specified in the request is incorrect. Please confirm the account information with the payer before contacting your account manager for further information. |

insufficient_funds | AM04 | 901 | The available balance in the Linked Account is insufficient. Please ensure funds are added to the Linked Account and retry. |

invalid_debtor_account_number | AC02 | 902 | The payer's bank account number is invalid. Please confirm the account number with the payer. |

order_cancelled | DS02 | 903 | The payer has placed a stop payment order on this debit. Contact the payer for further information. |

closed_debtor_account_number | AC05 | 905 | The payer's bank account is closed. Contact the payer to reopen the account, or create a new mandate to charge a different bank account. |

no_debit_allowed | NARR | 907 | The payer's bank account is not allowed to receive direct debits. Contact the payer's bank for further information. |

unsuccessful_direct_debit | AG07 | 908 | The payer's bank account has pending funds that have not cleared yet. Contact the payer's bank for further information. |

currency_account_mismatch | NARR | 909 | The currency of the direct debit does not match the currency of the payer's bank account. Contact the payer or payer's bank for further information. |

end_customer_deceased | MD07 | 910 | You cannot create a direct debit against the payer's bank account because the payer is deceased. Contact the payer's bank for further instructions. |

blocked_account | AC06 | 911 | The bank account has been blocked for EFT direct debits. Contact the payer to remove the block, or create a new mandate to charge a different bank account. |

incorrect_account_number | AC01 | 912 | The payer's bank account number is invalid. Please confirm the account number with the payer. |

missing_name | BE21 | 914 | The payer's name on the transaction does not match the account holder's name. |

no_mandate | MD01 | 915 | The direct debit mandate is not present. Please confirm that the payer or payer's bank has not cancelled the mandate before contacting your account manager for further information. |

not_in_accordance_with_mandate | NARR | 916, 919 | The payer has requested to return/reject the direct debit as it was not issued in accordance with the mandate. Contact the payer for further information. |

mandate_revoked | NARR | 917, 920 | The payer who authorised the debit has revoked the authorisation. You should not create further direct debits under this mandate until the issue has been resolved. |

missing_pre_notification | NARR | 918, 921 | The payer has requested to return/reject the direct debit as they have not received the pre-notification. You should not create further direct debits under this mandate until the issue has been resolved. |

institution_in_default | NARR | 990 | The payer's bank is facing insolvency or bankruptcy. Contact the payer's bank for further information. |