Qwilr saves $9,987 per month in unnecessary fees and hours of administration time

How Qwilr’s Finance Manager freed up his time to focus on more strategic initiatives by empowering teams with Borderless Cards.

A$100,000+

per year saved on FX related fees

A$18,000+

per year saved on USD SaaS spend like AWS and Intercom

70% savings

on international transfers to US, UK and EU

Qwilr is a technology business providing document design and automation perfect for proposals, pitch, and sales quoting.

Industry

Technology

Location

Location | Australia, US, UK, EU and more

Company size

150 – 200 employees

Adam Ingles

Finance Manager, Qwilr

"You’re crazy not to try Airwallex, especially if you are dealing with foreign currencies. It is easy to sign up, get verified, and test it with little risk."

Standing out from the crowd can be tough. Especially in B2B sales. Today, sales teams have state of the art technology helping build deal pipelines and automated sales outreach, but unfortunately, sales proposals haven’t caught up yet. It wasn’t until Qwilr came around that sales teams can create beautiful and dynamic online proposals, close a deal, and collect payment all in one place.

Founded in 2014 as a remote first technology business, Qwilr has customers in 60 markets globally, and to date has raised over A$12 million. As they grew beyond Australian shores and across borders, Qwilr’s Finance Manager faced numerous challenges. From the increasing amount of time it took to track a growing team’s expenses, to the risks of sharing corporate credit card details via spreadsheets, and managing their FX exposure, collecting revenue or paying staff and suppliers overseas.

Airwallex provided a complete business account to seamlessly manage each team’s expenses with flexible spend controls, multi-currency collections and transfers at market-leading FX rates. To date, Airwallex has helped Qwilr issue more than 30 cards in just a few clicks, give back 8 hours a month to the Finance Manager so he can focus on more strategic initiatives, and save more than $100,000 a year on international transactions and FX related fees.

Empowered each remote team to hit the ground running with virtual and physical cards.

Problem: As Qwilr grew from 10 to 50 employees, their single corporate credit card issued by a Big 4 Bank was no longer cut out for scaling an international business.

Adam Ingles

Finance Manager, Qwilr

"We used to have a shared company credit card floating around. It works when you have like 5-10 people. At that stage, you vett everyone individually, but you outgrow it pretty quickly."

While the process of sharing corporate cards was manual, it worked. Qwilr’s remote teams needed to pay for tools and resources to grow the business quickly. But it was simply too slow to ask the founders to approve each expense, and each line item was getting bigger and bigger so it was unfair to ask employees to be out of pocket while a reimbursement claim would be processed at the end of each month...

If anything happened to the card, the team was spending hours on the phone with the Big 4 Bank to cancel, and reissue the card which slowed down the team. Also, because everyone was using the same credit card, it was an accounting nightmare. It became increasingly difficult for Qwilr’s Finance Manager, Adam Ingles, to keep track of where money was going.

Solution: Now, at Qwilr, each department has their own virtual multi-currency cards. The cards were created instantly and are managed from one platform cutting down issuing time from 2 weeks to 5 minutes.

Adam Ingles

Finance Manager, Qwilr

"With Airwallex, you just open up the app, sign in and you can just update any of the cards, or issue new cards there with a few clicks"

Adam set up spending limits on the cards so that Qwilr’s employees don’t need to request approvals for pre-agreed budgets, reducing hours spent by teams. As a result, Qwilr team members know that they are trusted, have the full support from the leadership team, whilst also minimising the risk of misuse. Having a card for each department also saves Adam more than 8 hours each month attributing each cost line item to the correct GL codes with bank feeds flowing from Airwallex straight through into Xero.

Adam Ingles

Finance Manager, Qwilr

"We started with 1-2 departments, and now every team has their own virtual cards. It saves me a day a month in admin.”

Saved $18,000 per year on SaaS, advertising, and payroll expenses charged in different currencies.

Problem: As a remote first technology business, Qwilr works with SaaS tools, and pays staff living in the Philippines, Ukraine, United States and United Kingdom who prefer to be paid in their local currencies. This exposes Qwilr to FX risks and hidden international transaction fees.

Adam Ingles

Finance Manager, Qwilr

"When the AWS invoices come through, it costs us $500+ in hidden FX fees each time.”

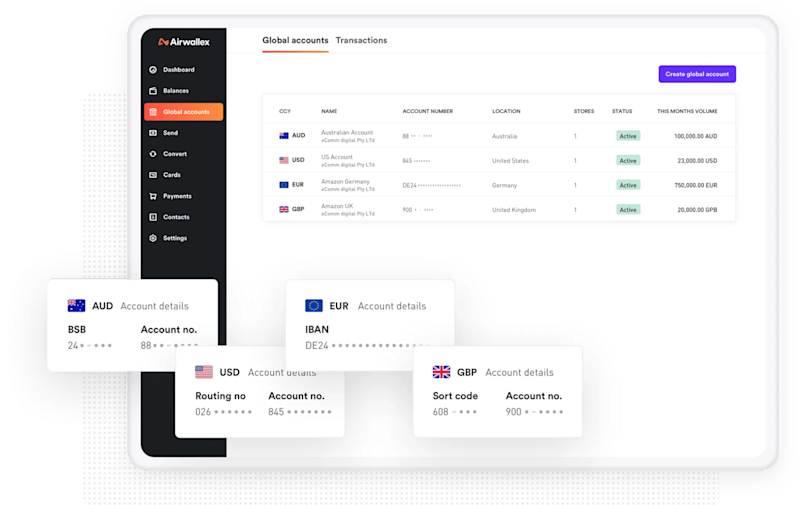

Solution: Using Airwallex, Qwilr’s teams use virtual cards and bank transfers to pay international business expenses like staff salaries, technology SaaS and FB Ads out of their four US, UK, EU and AU Global Accounts. The Global Accounts first pulls from Qwilr’s wallet which contains revenue from customers collected and held in foreign currencies to avoid FX market risk altogether. If there is not enough foreign currency available in Qwilr’s wallet, Airwallex gives Qwilr access to competitive FX rates with no hidden international transaction fees.

Kish Taneja

Account Manager, Airwallex

“Qwilr can be confident that Airwallex and I are there to support every step of the way of growth with an end to end international business account, allowing them to grow commercially with confidence, cut through complexity and focus on what matters."

More stories from Airwallex customers

See how our customers are finding Airwallex

"Airwallex have been a fantastic partner for Olsam Group as we grow our eCommerce brands to new channels and new markets. Their easy to use interface and integrations have been a joy for our finance team to use as we scale."

Sam Horbye

Co-Founder, Olsam

"For ME + EM, expanding into international markets such as the US has been our focus - and with Airwallex, we were able to use their local USD Global Account to collect from our Paypal US account, thereby allowing us to save 3% on each transaction. The process of working with Airwallex has been seamless - our suppliers get paid quickly, we have a dedicated Relationship Manager who has been really patient, helpful and quick to respond. I am keen to use their cards to pay for our ad spend in the near future to save further on our USD invoices."

Meera

Finance Manager, ME + EM

"We've had such a fantastic experience switching to Airwallex. Previously we were using a traditional bank to make all of our international transactions and they'd constantly lock us out of the account everytime we made a transfer, resulting in hours and hours of lost time on hold. Airwallex is secure, makes it super quick and simple to make and receive international payments."

Rupert

Managing Director, Perspective Pictures

“We used to pay Stripe between $5,000 and $10,000 a month in conversion fees because most of our customers pay in dollars. Now we funnel that money into our Airwallex US dollar account, we don’t have to pay commission. We’ve saved more than $100,000 so far this year”

Thomas Adams

Founder and CEO, Brandbassador

"We love Airwallex! It has considerably eased our invoicing and payments to contractors around the world. Sending and receiving money is much faster and cheaper than before."

Edle Tenden

Co-Founder, Mobile Transaction

“We are so glad that we have found Airwallex! There are no hidden charges, they are quick to respond to any queries and we had the smoothest transaction with amazing support from the team continually.”

Andreia Beja

Supply Chain Executive, Miss Patisserie

"Our water solutions company, Dropterra (go.dropterra.com) has partnered with Airwallex since inception and it has been the best banking and payment partner a company can think of. International transactions are easy, secure, and fast, the technology is incredible and their client service fantastic! We look forward to growing and deepening our relationship with Airwallex!"

Francois Schramek

Co-Founder, Dropterra