Supercharge your cross-border payment solutions

Streamline cross-border payments with our end-to-end solutions. Get multi-currency accounts, fast transfers, and payment acceptance all in one place. Our solutions let you operate like a local business, no matter where you are.

Power your global ambitions with our cross-border payment solutions

Operate like a local business wherever you are

Get accounts with local bank details to receive multi-currency funds, without having to set up traditional bank accounts around the world.

Expand your global reach with local payment methods

Reach more customers worldwide by offering 160+ local payment methods.

Improve cash flow with high-speed transfers

Pay out in as little as one business day using Airwallex’s proprietary payment network.

Manage cross-border transactions like a local

Receive multi-currency payments via Global Accounts

Get paid like a local via local currency accounts with local bank details, in 70+ countries.

Avoid forced conversions with like-for-like settlement

Settle and hold funds in the same currency that you receive them in, avoiding foreign exchange (FX) conversion fees.

Convert funds at market-leading foreign exchange (FX) rates

Access competitive interbank rates and save up to 80% on FX fees

Streamline payouts and expense management

Transfer funds faster via local payment rails

Pay out to 200+ countries, with 120+ using local rails instead of SWIFT. 93% of transfers arrive within the same day.

Simplify global spend with Corporate Cards

Issue multi-currency Visa cards in 60 markets and manage all business expenses from a real-time dashboard.

Streamline multiple payments with Batch Transfers

Pay up to 1,000 recipients across countries, currencies, and transfer methods.

Drive conversions with localised checkout experiences

Boost checkout rates with automatic currency conversion

Let customers browse and pay in their local currency.

Increase sales with multi-currency payments

Accept payments in 130+ currencies and make it easy for customers to pay you wherever they are.

Reduce checkout friction with 160+ local payment methods

Let customers pay with familiar methods by offering 160+ local payment methods and major card schemes like Visa, Mastercard, American Express, and more.

Unlock your growth potential with seamless integration and scalable solutions

Leverage built-in compliance support

With our licences and permits in 80+ countries, you can enter new markets without navigating regulatory complexities on your own.

Reduce time to market

Start accepting payments in minutes with our low and no-code solutions, whether it’s via your own site or popular platforms like Shopify, Magento, WooCommerce, and more.

Avoid costly errors with software integration

Automate reconciliation with our integrations with leading accounting software, reducing manual effort and manual errors.

“Airwallex covers everything which small businesses need to act like the bigger players on a global level. We can transact in local currencies with customers in local markets. ApprovalMax has total control over the flow of cash in different currencies. We have the ability to do all kinds of local payments and international payments. It breaks down barriers.”

Helmut Heptner

Co-Founder and Director of Operations, ApprovalMax

“Airwallex has been instrumental in our journey by streamlining our global payments and reducing financial complexities, enabling us to focus more on customer experience.”

David Benzimra

CEO & Co-Founder, WeSki

"Previously, we had no visibility in the whole transfer process. Cross-border payments can be quite stressful and it was frustrating to have no one to turn to when payments got stuck. Airwallex has been a game-changer for us because they've given us complete control over our cross-border payments. They also really understand the unique challenges we face in global operations, on a business level."

Ying Tze Her

Chief Operating Officer, Saturday Club

“Airwallex’s global network made sending and receiving international payments easy. We avoid cross-border fees by paying overseas suppliers in their local currency. Sometimes, transfers are even done within the day.”

Alan Ang

Director and Co-founder, EU Holidays

“Airwallex covers everything which small businesses need to act like the bigger players on a global level. We can transact in local currencies with customers in local markets. ApprovalMax has total control over the flow of cash in different currencies. We have the ability to do all kinds of local payments and international payments. It breaks down barriers.”

Helmut Heptner

Co-Founder and Director of Operations, ApprovalMax

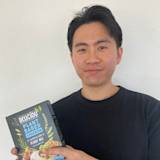

"I see Airwallex as a one-stop shop for payment acceptances, global payouts, and so much more. Here’s how I’d put it to other businesses: you can start in one place with Airwallex, and then you can grow."

Daven Johnson

Founder & CEO of Gimme Swag

“With Airwallex, our financial operations are more efficient and run smoother. We can track all our expenses in one place and it works seamlessly with our accounting software.”

Thomas Dazard

CFO, From Future

"Airwallex solves the problem of creating currency accounts almost instantly. I can click one button to create a UK account. We haven’t looked back since day one."

Peter Park

Business Improvement Manager, Deliciou

“We have contractors based in China, the US, and Europe, and our Airwallex Global Account enables us to make global payments from one simple portal. Having Airwallex as our global trusted partner means we can spend less time on the phone to the bank, and more time instead focusing on growing our business both domestically and internationally.”

Richard Li

Co-founder & CEO, July

SECURE CROSS-BORDER PAYMENTS

Safeguard your global revenue

Our fraud engine is fully integrated into our Payments platform, and helps you stop fraud before it occurs. It leverages our own models combined with external data sources to discern fraudulent transactions from legitimate ones.

Smart 3D Secure optimisation

Maximise payment acceptance while staying compliant with local regulations. Our 3DS engine automatically picks the best strategy based on transaction risk, applicable regulatory exemptions, and policies.

AI-powered fraud engine

Our fraud engine uses machine learning trained on millions of transactions to detect and prevent fraud. This leads to higher payment success rates and lower fraud rates, protecting your business’s revenue.

Highest security standards

We meet the highest international security standards for businesses that accept payments, including PCI DSS, SOC1, and SOC2 compliance, in addition to our local regulatory requirements.

Frequently Asked Questions

What payment methods can I offer with Airwallex?

With Airwallex’s global payment network, you can offer 160+ local payment methods and major card schemes such as Visa, Mastercard, Amex, and more. Besides credit cards and debit cards, Airwallex supports payment methods across digital and mobile wallets, buy now, pay later (BNPL) options, bank transfers, and more – so you can provide customers with their preferred way to pay.

The availability of specific payment methods may depend on your business’ location. Find out more about our payment methods.

How can I improve payment acceptance rates for international transactions?

You can improve payment acceptance rates with a robust machine-learning powered optimisation engine that analyses transaction data in real-time.

Airwallex’s optimisation engine is powered by advanced machine learning tools such as smart MCC (Merchant Category Code) assignment, automatic retries, ISO-optimised messaging and routing, and strong security protocols (e.g. 3D Secure) to improve your payment acceptance success rates.

How can I receive payments?

You can receive payments via bank transfers, direct debits, cards, digital payment methods, buy now, pay later (BNPL) options, marketplace integrations, and more.