Qwilr saves $9,987 per month in unnecessary fees and hours of administration time

How Qwilr’s Finance Manager freed up his time to focus on more strategic initiatives by empowering teams with Borderless Cards.

A$100,000+

per year saved on FX related fees

A$18,000+

per year saved on USD SaaS spend like AWS and Intercom

70% savings

on international transfers to US, UK and EU

Qwilr is a technology business providing document design and automation perfect for proposals, pitch, and sales quoting.

Industry

Technology

Location

Location | Australia, US, UK, EU and more

Company size

150 - 200 employees

Adam Ingles

Finance Manager, Qwilr

"You’re crazy not to try Airwallex, especially if you are dealing with foreign currencies. It is easy to sign up, get verified, and test it with little risk."

Standing out from the crowd can be tough. Especially in B2B sales. Today, sales teams have state of the art technology helping build deal pipelines and automated sales outreach, but unfortunately, sales proposals haven’t caught up yet. It wasn’t until Qwilr came around that sales teams can create beautiful and dynamic online proposals, close a deal, and collect payment all in one place.

Founded in 2014 as a remote first technology business, Qwilr has customers in 60 markets globally, and to date has raised over A$12 million. As they grew beyond Australian shores and across borders, Qwilr’s Finance Manager faced numerous challenges. From the increasing amount of time it took to track a growing team’s expenses, to the risks of sharing corporate credit card details via spreadsheets, and managing their FX exposure, collecting revenue or paying staff and suppliers overseas.

Airwallex provided a complete business account to seamlessly manage each team’s expenses with flexible spend controls, multi-currency collections and transfers at market-leading FX rates. To date, Airwallex has helped Qwilr issue more than 30 cards in just a few clicks, give back 8 hours a month to the Finance Manager so he can focus on more strategic initiatives, and save more than $100,000 a year on international transactions and FX related fees.

Empowered each remote team to hit the ground running with virtual and physical cards.

Problem: As Qwilr grew from 10 to 50 employees, their single corporate credit card issued by a Big 4 Bank was no longer cut out for scaling an international business.

Adam Ingles

Finance Manager, Qwilr

"We used to have a shared company credit card floating around. It works when you have like 5-10 people. At that stage, you vett everyone individually, but you outgrow it pretty quickly."

While the process of sharing corporate cards was manual, it worked. Qwilr’s remote teams needed to pay for tools and resources to grow the business quickly. But it was simply too slow to ask the founders to approve each expense, and each line item was getting bigger and bigger so it was unfair to ask employees to be out of pocket while a reimbursement claim would be processed at the end of each month...

If anything happened to the card, the team was spending hours on the phone with the Big 4 Bank to cancel, and reissue the card which slowed down the team. Also, because everyone was using the same credit card, it was an accounting nightmare. It became increasingly difficult for Qwilr’s Finance Manager, Adam Ingles, to keep track of where money was going.

Solution: Now, at Qwilr, each department has their own virtual multi-currency cards. The cards were created instantly and are managed from one platform cutting down issuing time from 2 weeks to 5 minutes.

Adam Ingles

Finance Manager, Qwilr

"With Airwallex, you just open up the app, sign in and you can just update any of the cards, or issue new cards there with a few clicks"

Adam set up spending limits on the cards so that Qwilr’s employees don’t need to request approvals for pre-agreed budgets, reducing hours spent by teams. As a result, Qwilr team members know that they are trusted, have the full support from the leadership team, whilst also minimising the risk of misuse. Having a card for each department also saves Adam more than 8 hours each month attributing each cost line item to the correct GL codes with bank feeds flowing from Airwallex straight through into Xero.

Adam Ingles

Finance Manager, Qwilr

"We started with 1-2 departments, and now every team has their own virtual cards. It saves me a day a month in admin.”

Saved $18,000 per year on SaaS, advertising, and payroll expenses charged in different currencies.

Problem: As a remote first technology business, Qwilr works with SaaS tools, and pays staff living in the Philippines, Ukraine, United States and United Kingdom who prefer to be paid in their local currencies. This exposes Qwilr to FX risks and hidden international transaction fees.

Adam Ingles

Finance Manager, Qwilr

"When the AWS invoices come through, it costs us $500+ in hidden FX fees each time.”

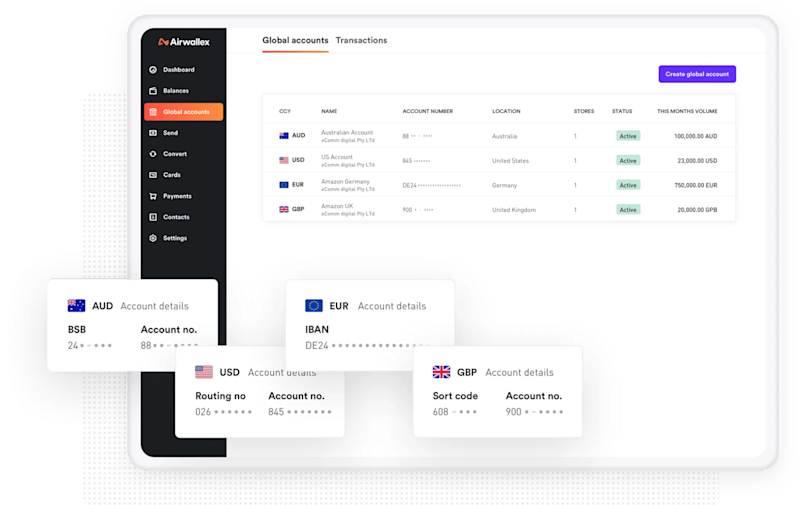

Solution: Using Airwallex, Qwilr’s teams use virtual cards and bank transfers to pay international business expenses like staff salaries, technology SaaS and FB Ads out of their four US, UK, EU and AU Global Accounts. The Global Accounts first pulls from Qwilr’s wallet which contains revenue from customers collected and held in foreign currencies to avoid FX market risk altogether. If there is not enough foreign currency available in Qwilr’s wallet, Airwallex gives Qwilr access to competitive FX rates with no hidden international transaction fees.

Kish Taneja

Account Manager, Airwallex

“Qwilr can be confident that Airwallex and I are there to support every step of the way of growth with an end to end international business account, allowing them to grow commercially with confidence, cut through complexity and focus on what matters."

More stories from Airwallex customers

Bekijk hoe onze klanten Airwallex vinden

“Airwallex is een geweldige partner voor Olsam Group naarmate we onze e-commerce merken uitbreiden naar nieuwe kanalen en nieuwe markten. Hun gebruiksvriendelijke interface en integraties zijn een genot voor ons finance team om mee te werken terwijl we groeien.”

Sam Horbye

Medeoprichter, Olsam

"Voor ME + EM hebben we ons gericht op uitbreiding naar internationale markten zoals de VS, en Airwallex stelde ons in staat om een wereldwijde rekening in USD te gebruiken om geld te innen van ons Amerikaanse PayPal-account. Daarmee besparen we 3% op elke transactie. De samenwerking met Airwallex is heel goed: onze leveranciers worden snel betaald, we hebben een dedicated relatiemanager die geduldig is, een helpende hand biedt en snel reageert. In de nabije toekomst wil ik graag hun betaalkaarten gebruiken om onze advertentiekosten te betalen, zodat we nog meer geld kunnen besparen op onze facturen in USD."

Meera

Financieel manager, ME + EM

"De overstap naar Airwallex was een geweldige ervaring. Voorheen deden we zaken met een traditionele bank om al onze internationale transacties uit te voeren. Deze banken blokkeerden bij elke overschrijving onze rekening, wat erg tijdrovend was. Met Airwallex kunnen we veilig en snel internationale betalingen doen en ontvangen."

Rupert

Managing Director, Perspective Pictures

“Vroeger betaalden we Stripe tussen de $5.000 en $10.000 per maand aan conversiekosten omdat de meeste van onze klanten in dollars betalen. Nu we dat geld naar onze Airwallex US dollar-rekening sturen, hoeven we geen commissie te betalen. We hebben tot nu toe meer dan $100.000 bespaard dit jaar.”

Thomas Adams

Oprichter en CEO, Brandbassador

"We houden van Airwallex! Het heeft onze facturering en betalingen aan aannemers over de hele wereld aanzienlijk vereenvoudigd. Geld verzenden en ontvangen is veel sneller en goedkoper dan voorheen."

Edle Tenden

Medeoprichter, Mobile Transaction

“We zijn zo blij dat we Airwallex hebben gevonden! Er zijn geen verborgen kosten, ze reageren snel op vragen en we hadden een probleemloze transactie met verbazingwekkende ondersteuning van het team.”

Andreia Beja

Supply Chain Executive, Miss Patisserie

"Ons bedrijf voor wateroplossingen, Dropterra (go.dropterra.com) werkt al sinds onze oprichting samen met Airwallex en het is de beste bank- en betalingspartner die een bedrijf zich kan wensen. Internationale transacties zijn eenvoudig, veilig en snel, de technologie is ongelooflijk en hun klantenservice is fantastisch! We kijken ernaar uit om onze relatie met Airwallex uit te breiden en te verdiepen!"

Francois Schramek

Medeoprichter, Dropterra