How does Airwallex help big businesses operate with more agility?

‘Legacy’ is a loaded term. On the one hand, it can suggest a level of status; running a legacy business is a huge undertaking to be proud of. On the other, legacy businesses are more likely to experience inertia; constrained by outdated processes and systems.

In a business landscape that’s obsessed with start ups and scalability, big businesses can be at a disadvantage. While they have the trust, the brand name and the resources – some lack the agility to maintain appeal in a fast-moving world.

Airwallex is trusted by small businesses looking to grow, but we’re just as passionate about helping big businesses evolve and stay competitive. We’re proud to name some of Australia (and the world’s) biggest companies, including Qantas and Shein, as satisfied clients.

Why are we a favourite for Australian big businesses? We help enterprises operate with more agility, assisting them to become future-fit and fulfil the next stage of their business potential.

Why do big businesses need to focus on innovation?

There’s danger in always making the same ‘safe’ decisions.

While we’re not in the business of fear-mongering, the lingering shadows of big businesses who have failed to innovate – and paid the price – are everywhere.

As Innovation Expert Tendayi Viki writes for Forbes; “Xerox invented most of the technologies that we use in personal computing today. But Xerox is not one of the largest computing companies in the world today. Kodak invented the digital camera and still filed for bankruptcy in 2012. Nokia was one of the pioneers of the smartphone and still lost significant market share to the iPhone.”

What do these businesses have in common? Each failed to embrace a changing market. They failed to adapt, and consequently lost out to businesses who prioritised innovation.

Which Airwallex tools drive innovation for big businesses?

As a fast-moving tech company, our products are always evolving to fit your needs. If your business is looking to innovate financial operations and customer experience, taking advantage of our purpose-built tools could be a game-changer.

Big businesses have big demands, and our team will work with yours to complete unique solutions using our Core API.

Airwallex’s Core API

Our Core API is your gateway to integrating products that can bring new levels of efficiency and revenue to your business.

We know that big businesses have existing tech stacks and workflows, and our suite of APIs won’t disrupt that. Our high-quality developer tools, straightforward documentation, and cloud native solutions, easily integrate with your existing systems.

Developers love our best-in-class tools, which can be integrated in a flash with flexible deployment options. This leaves more time for whitelabelling (you apply your branding to our products) and scaling the three core opportunities of our Embedded Finance suite; Global Treasury, Banking-as-a-Service (BaaS) and Payments for Platforms.

In short, our amazing features will become your amazing features. And the value can’t be underestimated; an independently conducted Forrester report found Airwallex Embedded Finance solutions deliver a whopping ROI of 237%.

Global Treasury

Your customers can collect, store, and move money internationally using Airwallex’s powerful Global Treasury infrastructure.

According to the Forrester report, after the investment in Airwallex’s Global Treasury solution, clients improved customer satisfaction, customer retention, and revenue growth. This empowered them to reallocate resources to improving their solutions and platform, instead of building and maintaining payments and treasury infrastructure.

Other benefits included improved operating profit from expansion into new markets, reduced FX and transaction costs, and skipping payments integration setup and maintenance costs.

Banking-as-a-Service

Banking-as-a-Service (or BaaS) can make a big difference to your customer engagement and loyalty, as your business essentially becomes a de facto bank – offering financial services like accounts and card issuing.

BaaS creates a ‘closed loop’ experience, meaning your patrons no longer need to rely on third party financial institutions, like banks, to manage their money. Instead, they can do it on your platform.

A lender, for example, can create their own client bank accounts in which to deposit funds. They can then track how much their client has spent and repaid, then programmatically offer additional funds when those accounts run low. This level of visibility used to be the privilege of banks and credit card companies. Now, all kinds of businesses can offer their clients this service.

Payments for Platforms

Our Payments for Platforms solution creates a frictionless payment experience for your customers; and is loved by big businesses such as marketplaces, SaaS platforms and on-demand service providers.

With our whitelabelling capabilities, our streamlined tools appear entirely as your own. You become free to monetise payments as you like; for example - by bundling payments with other paid premium features or charging a transaction fee for each payment you process.

You can make money, but you can also save money. When you use our tools you slash implementation time and farewell costly ongoing maintenance. We take care of it all, and are constantly evolving our products in-line with our customers' needs to boot.

How two big businesses innovate with Airwallex

Companies of different sizes use our flexible product suite in very different ways. We’re proud to have one of the most versatile platforms in the game, and it’s a pleasure to see it leveraged by bigger businesses to drive success.

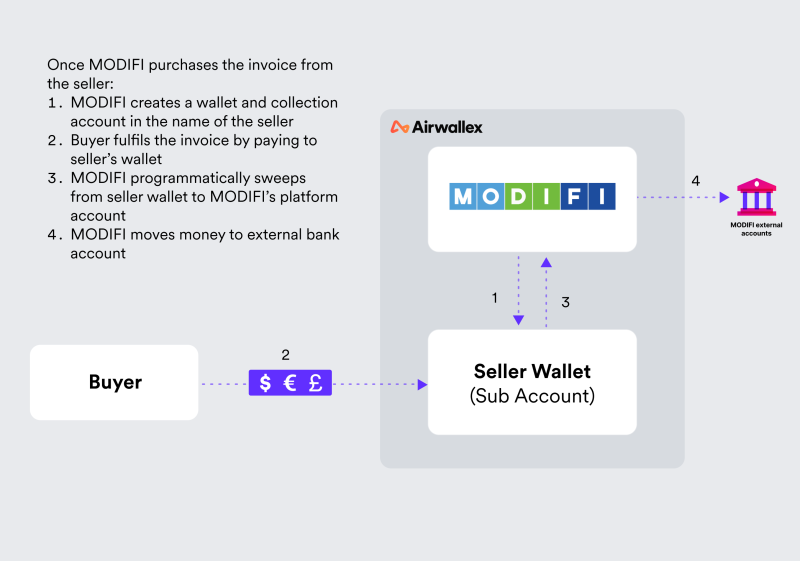

Modifi

MODIFI helps businesses manage international trade through its innovative digital platform, enabling sellers to receive payments instantly and offering buyers the option to pay up to 180 days later.

To pursue their next growth stage, MODIFI needed a solution that:

Enabled them to set up accounts in the seller’s name

Helped them receive payments vial local payment rails (rather than the inefficient and costly SWIFT system)

Improved payment visibility

Worked across multiple currencies and geographies

Airwallex’s Embedded Finance tools were the answer. Airwallex’s Global Accounts are embedded into the MODIFI platform and essentially act as collection accounts for MODIFI. These accounts can be created instantly in their client’s name via API, and simplify the collection process and operations.

“Airwallex is our payments partner of choice when it comes to removing the friction associated with traditional financing. By using Airwallex, we offer exporters a seamless solution which eases trade bottlenecks and liquidity issues. Airwallex is a key partner in our mission to deliver finance to companies seeking sustainable growth.” - Sven Bauer, Chief Operating Officer, MODIFI

OurCrowd

OurCrowd is an online global venture investing platform that empowers institutions and individual accredited investors to engage with emerging technology companies at an early stage.

OurCrowd needed a solution to allow customers to pay in real time via their preferred local payment methods. Looking to offer their investors a more localised experience, OurCrowd kicked off a project with Airwallex to offer a truly global payment solution.

With the Airwallex API, OurCrowd can set up dedicated accounts for each individual investor’s preferred currency. Once the investor selects a startup or other deal they wish to invest in, they can choose their preferred currency and send the funds directly to a dedicated wallet for that investment opportunity.

By integrating a combination of Global Business Accounts, LockFX, and Payouts, OurCrowd can now collect funds in an investor’s preferred currency, lock in the exchange rate for 24 hours, and transfer to a startup in USD – all via the Airwallex platform.

“Airwallex has allowed us to modernise our payments infrastructure and cater to new investors all over the world.” - Micky Sapir, VP of Product, OurCrowd

Are you ready to innovate?

It’s 2024, and the business landscape is moving faster than ever. Legacy businesses need to make sure they don’t get left behind, or lost in the noise of start-up and scale-up success stories.

Innovation and business agility are non-negotiable if you want to stay competitive. If you’d like to explore how our next generation solutions can help, get in touch with our Customer Success team. We’ll explore your business needs, and collaborate with you to create solutions that can help you take your business to the next level.

Get in touch now, visit our homepage and hit the 'Contact Sales' button to book your appointment.

Disclaimer: This information doesn’t take into account your objectives, financial situation, or needs. It is important for you to read the Product Disclosure Statement (PDS) for the Direct Services, which is available here. The Airwallex Group does not warrant, guarantee, or make any representations regarding the correctness, accuracy, or reliability of any statistics and information disclosed in this article as originating from a third party source.

Share

Izzy is a business finance writer for Airwallex. She specialises in thought leadership that empowers businesses to grow without boundaries.

Related Posts

Cookies on the Airwallex website

We use cookies to give you a better experience on our website. If you continue without changing your settings, we’ll assume that you are happy to receive cookies. However, if you would like to, you can change your cookie any time here